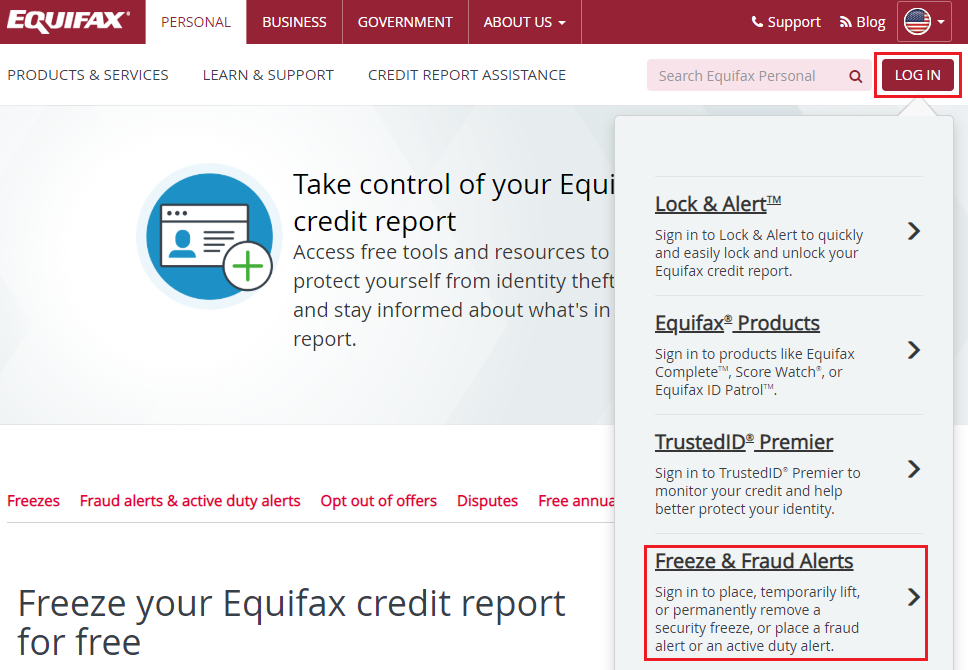

Written requests should include your name, address and Social Security number as well as a six-digit PIN to associate with your TransUnion freeze.Ĭredit Freeze FAQs How much does a credit freeze cost? When submitting a request by mail, you’ll need to fill out an Equifax Security Freeze Request Form and include copies of proof of identity and proof of address documentation. You can find a complete list of information/documentation that must be submitted with your written request at. To help you get started, the webpages and contact information for the three bureaus are listed below. You may also temporarily lift a freeze (aka “thaw” your credit) and permanently remove a freeze via these methods using the account and/or personal identification number (PIN) you have established with each bureau. Only setting up a security freeze with one of them is not sufficient, since creditors do not report to all three.Įach credit bureau permits consumers to request a security freeze online, by phone or by mail. You must contact each of these bureaus to request separate freezes. The three nationwide credit reporting companies are Experian, Equifax and TransUnion. Since these consumers are unable to monitor their own credit or protect themselves from fraud, caregivers with durable financial power of attorney (POA) or court-appointed guardianship can request security freezes for their on their behalf. A credit freeze provides invaluable peace of mind.Ī certain cohort of “protected consumers,” which includes incapacitated individuals and those who have been appointed a guardian, should absolutely be protected by a credit freeze. A busy family caregiver may not have the time or energy to monitor their own credit report, let alone their loved one’s credit activity. When it comes to seniors and their family caregivers, extra protection is crucial. I strongly recommend that all consumers consider placing security freezes on their credit since recovering from identity theft can be a long and difficult process. It’s best to be proactive about preventing identity theft, especially if you rarely need to grant a new creditor access to your credit activity and history.

Who Should Freeze Their Credit?ĭata breaches are increasingly common and the likelihood that a person’s credit report and other sensitive information have already been exposed is high. Therefore, a credit freeze is a method of stopping fraudulent activity before it occurs. If the credit report is blocked, then the creditor is unable to review it and will typically deny the application.

When someone submits a tenant application or credit application (for a loan or credit card), the creditor will request a copy of the applicant's credit report.

0 kommentar(er)

0 kommentar(er)